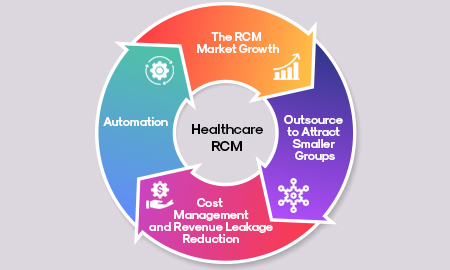

Choosing the right healthcare revenue cycle management (RCM) partner can significantly impact your organization’s financial health. Medical billing and coding complexities, increasing net collections, and handling denial management make RCM one of the most challenging mechanisms for healthcare providers. Outsourcing your RCM to a reputable agency can be a game-changer, but it’s crucial to consider critical factors that ensure your chosen partner can meet your needs effectively.

Factors to Consider When Choosing a Revenue Cycle Management Partner

Performance Guarantees

Start by assessing whether potential RCM partners offer performance guarantees. Many top RCM service providers emphasize performance-based fee structures, providing incentives to outperform and exceed established key performance indicators (KPIs) such as collection rates, claim denial rates, and overall management efficiency.

“Trust is the foundation of a successful business relationship. Ensuring secure payment transactions builds and protects your reputation,” says a Healthcare CFO

Denial Management Strategies

According to a recent survey, hospitals that outsource RCM services report a 20% increase in net collections and a 15% reduction in claim denials. Additionally, the average cost to rework a denied claim is $25, highlighting the financial impact of effective denial management.

Denial management is a critical aspect of RCM. Statistics show that insurance carriers reject or deny one of every four medical claims on the first submission, costing healthcare providers millions in lost revenue. Effective denial management can significantly reduce the administrative burden and improve cash flow. Ensure your RCM partner has robust strategies to address and reduce claim denials, streamlining workflows for greater efficiency.

Effective denial management is about more than recovering lost revenue; it’s about preventing revenue loss in the first place.

Certified Coders and Billers

Your RCM partner must have appropriately certified medical coders and billers. Despite advanced software, knowledgeable coders are essential for accurate data entry and follow-up on discrepancies. Ensure the staff knows the American Association of Healthcare Administrative Management (AAHAM), the Healthcare Financial Management Association (HFMA), and other best practices.

Scalability for Growth

Scalability is a crucial factor. Your RCM partner should have the resources to handle fluctuating workloads and scale operations up or down as needed. This flexibility helps you manage costs efficiently while ensuring that your claims are processed promptly, regardless of volume. Jane Doe adds, “Scalability in the revenue cycle allows us to maintain operational efficiency even during peak seasons.”

Detailed Reporting

Choose an RCM partner that prioritizes detailed reporting at all stages of the RCM process. Accurate and comprehensive reports on KPIs such as claim denials, debt management, and collection rates are vital for tracking financial stability. Regular, detailed reports help healthcare executives, CFOs, and administrators make informed decisions and maintain profitability.

Enhanced Security Measures

Security is paramount in RCM. Ensure your partner has robust measures to protect electronic health records (EHRs) and payment data. Investigate their compliance with HIPAA requirements and risk assessment and mitigation protocols. Data breaches can have severe consequences, so your partner must prioritize patient data security.

Effective Denial Management in the Revenue Cycle

Effective denial management is a cornerstone of successful RCM. Denied claims represent unpaid services or delayed revenue. Common reasons for claim denials include missing information, coding errors, and lack of medical necessity. A good RCM partner will have a dedicated team to address these issues promptly, ensuring that denied claims are corrected and resubmitted quickly.

Enhancing the Patient Experience

Improving patient collections is not just about financial gains; it also enhances the patient experience. Engaging patients early in the billing process, offering multiple payment options, and providing clear communication about their financial responsibilities can lead to higher satisfaction rates and better compliance with payment plans.

A positive patient experience in billing can significantly improve collection rates and patient satisfaction.

Selecting the right RCM partner involves more than just looking at cost savings. It requires a comprehensive evaluation of their capabilities, certifications, scalability, and security measures. Fusion CX offers detailed reporting, certified staff, and robust denial management strategies to ensure your financial health. Contact us today to learn how we can optimize your revenue cycle and improve patient collections.